123

Deepening Your Understanding of Our Mission and Programs

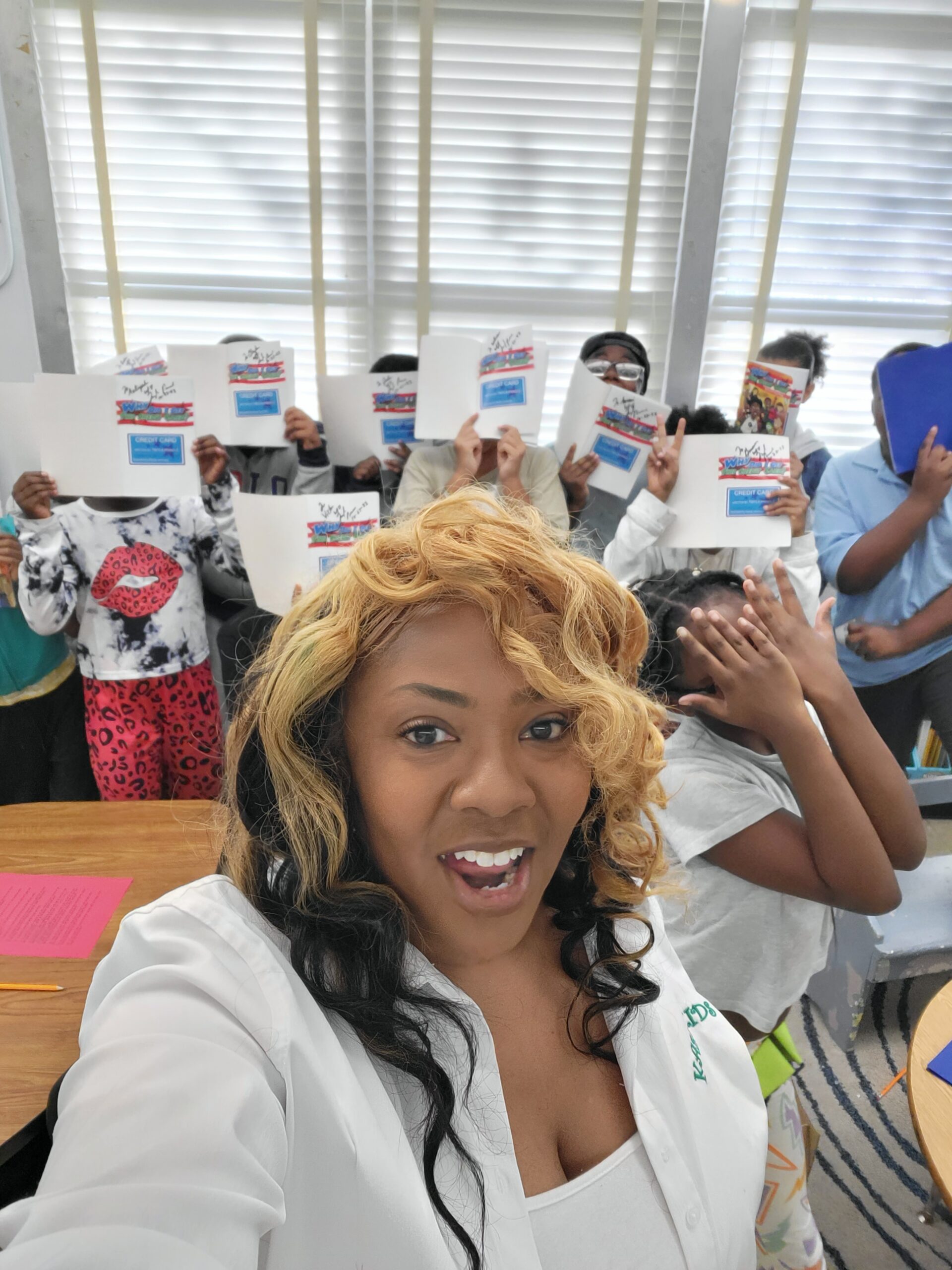

About Kash Kids

Kash Kids was founded with a vision to empower children with the financial knowledge and skills they need to lead successful and financially secure lives. We believe that financial literacy is not just an essential life skill but a key to breaking the cycle of poverty and building a prosperous future for individuals and communities.

Our Programs

Kash Kids offers a variety of programs tailored to different age groups and learning styles. Our goal is to make financial education engaging, practical, and fun for every child.

School Program

- We partner with schools to integrate financial literacy into the regular curriculum. Our programs are designed to align with educational standards and are delivered by trained educators.

After-School Clubs

- Our after-school clubs provide a relaxed and interactive environment where children can dive deeper into financial topics, participate in hands-on activities, and develop practical money management skills.

Summer Camps

- Our summer camps offer an immersive financial literacy experience. Through games, workshops, and real-world simulations, children learn essential financial skills while having fun.

Workshops and Events

- We organize workshops and community events to reach a broader audience. These events feature interactive sessions, guest speakers, and practical exercises that make learning about finance exciting and accessible.

Virtual Reality Platform

Our virtual reality (VR) platform is a unique feature of Kash Kids that sets us apart. The VR platform allows students to immerse themselves in realistic financial scenarios, such as running a business, managing a household budget, or making investment decisions. This interactive approach helps children understand the consequences of their financial choices in a safe and controlled environment.

Our Curriculum

Our curriculum covers a wide range of financial topics, including:

Budgeting

Understanding income and expenses, creating and managing a budget.

Saving

The importance of saving, different savings strategies, and goal setting.

Investing

Basic principles of investing, types of investments, and the power of compound interest.

Credit

Understanding credit, how to use it responsibly, and the impact of credit scores.

Debt Management

Differentiating between good and bad debt, strategies for managing and paying off debt.

Impact Stories

We are proud of the impact Kash Kids has had on thousands of children and their families. Here are some of their stories:

“Before Kash Kids, I didn’t understand why saving money was important. Now I have my own savings goal, and I’m excited to reach it!”

– 4th Grade Student

“Kash Kids has given our students the tools they need to make smart financial decisions. It’s incredible to see their confidence grow.”

– Teacher

“The VR platform is amazing! It made learning about money so much fun, and I feel like I really understand how to manage my finances now.”

– 6th Grade Student

Join Us

We invite you to join the Kash Kids community. Whether you are a parent, educator, or community leader, there are many ways to get involved:

Volunteer

Share your time and expertise by volunteering with our programs and events.

Donate

Support our mission by making a donation to help us reach more children with essential financial education.

Partner

Collaborate with us to bring Kash Kids programs to your school, organization, or community.

Together, we can create a brighter financial future for the next generation.

Connect on Social Media

Stay connected and follow my journey on social media. Join the conversation, share your thoughts, and stay updated on my latest projects, events, and insights.

Thank you for your interest, and I look forward to connecting with you!